Sending money internationally has become increasingly common in today’s interconnected world. For individuals in the UK with family, friends, or business interests in the Philippines, understanding the various methods and considerations for sending money is crucial. This comprehensive guide will explore the best methods, associated fees, exchange rates, and essential tips for sending money from the UK to the Philippines.

Bank Transfers: A Traditional Approach

Bank transfers are a conventional method for sending money from the UK to the Philippines. This process involves electronically transferring funds from your UK bank account to the recipient’s bank account in the Philippines. While bank transfers are generally secure, they may not always be the fastest option, and fees can vary depending on the banks involved. It’s essential to inquire about any applicable fees and processing times before initiating a bank transfer.

Money Transfer Services: Quick and Convenient

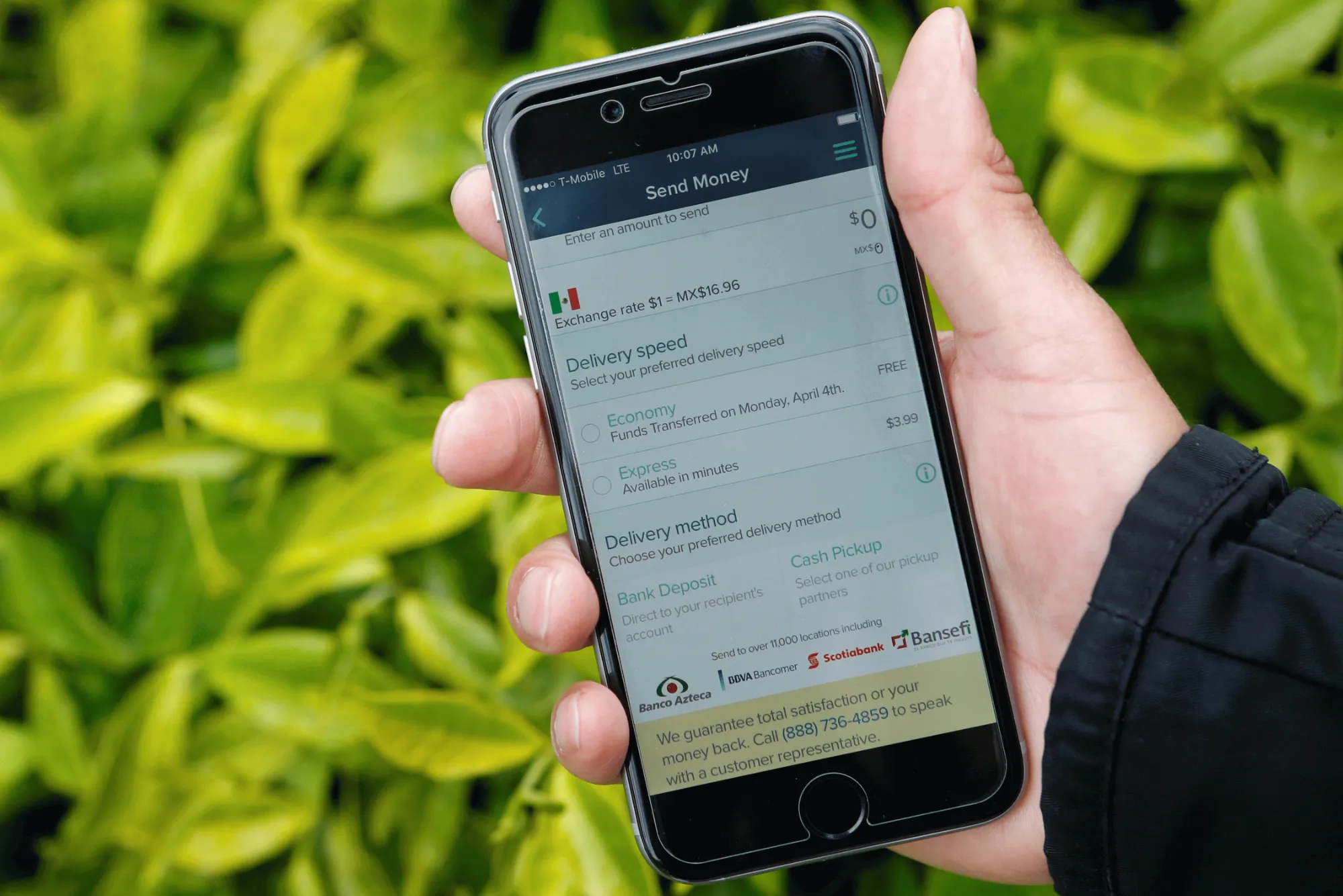

Money transfer services such as Western Union, MoneyGram, or TransferWise offer a convenient alternative for sending money from the UK to the Philippines. These services allow individuals to send money online or through physical locations for quick and efficient transfers. While money transfer services may charge fees for their services, they often offer competitive exchange rates and can be a faster option compared to bank transfers.

Online Payment Platforms: Instant Transfers

With the rise of digital banking and online payment platforms, sending money from the UK to the Philippines has become more accessible and efficient. Platforms like PayPal, Revolut, and Payoneer enable users to send money instantly to recipients in the Philippines. These platforms typically offer lower fees compared to traditional bank transfers or money transfer services and provide the added convenience of instant transfers. However, it’s essential to ensure that both you and the recipient have accounts with the same platform to facilitate the transfer smoothly.

To send money from the Philippines to the United Arab Emirates (UAE), several options are available. One common method is through international money transfer services such as Western Union, MoneyGram, or TransferWise

Cryptocurrency Remittances: Emerging Option

Cryptocurrency remittances have emerged as an alternative option for sending money internationally, including from the UK to the Philippines. Platforms like Coinbase, Binance, or BitPesa allow users to convert their UK pounds into cryptocurrencies like Bitcoin or Ethereum and transfer them to recipients in the Philippines. Recipients can then convert these digital assets back into local currency. While cryptocurrency remittances offer fast and potentially lower-cost transactions, it’s crucial to consider the volatility of cryptocurrency prices and any associated fees.

Factors to Consider

When sending money from the UK to the Philippines, several factors should be considered to ensure a smooth and cost-effective transaction:

Exchange Rates: Compare the exchange rates offered by different service providers to maximize the value of your money. Exchange rates can fluctuate, so it’s essential to monitor them closely and choose a provider offering favorable rates.

Fees: Consider the fees charged by banks, money transfer services, online platforms, or cryptocurrency exchanges for sending money to the Philippines. While some providers may offer low or zero fees for certain transactions, others may have hidden charges or higher exchange rate markups.

Speed: Depending on your urgency, choose a method that offers the desired speed of transfer. Bank transfers may take several business days, while some money transfer services and online platforms provide instant or same-day transfers for an additional fee.

Security: Prioritize the security of your funds by choosing reputable service providers with robust encryption and fraud prevention measures in place. Ensure that the chosen method complies with regulatory requirements for international money transfers.

Recipient Convenience: Consider the convenience for the recipient in accessing the funds. While bank transfers deposit money directly into the recipient’s bank account, money transfer services may offer options for cash pickup at designated locations in the Philippines.

Sending money from the UK to the Philippines involves considering various factors such as exchange rates, fees, speed, security, and recipient convenience. Whether you choose traditional bank transfers, money transfer services, online payment platforms, or cryptocurrency remittances, it’s essential to weigh your options carefully and choose a reliable service provider. By understanding the available methods and considerations, you can ensure that your funds reach their intended destination efficiently and securely. Keep these factors in mind to facilitate seamless transactions and support your financial connections with the Philippines.